For the last year almost, Ben and I have been saving around 15% of our income.

Ideally I’d like to be saving 20%, but we’ve got debts to pay off, and until they’re gone…

And actually, it’s not quite accurate to say we’ve been saving 15%, because almost 10% of that amount has been going to paying down said debt. (If you’re confused about why I put “Paying Down Debt” in the Savings column instead of the Needs or Wants column, check out My Philosophy on Needs vs. Wants vs. Savings.)

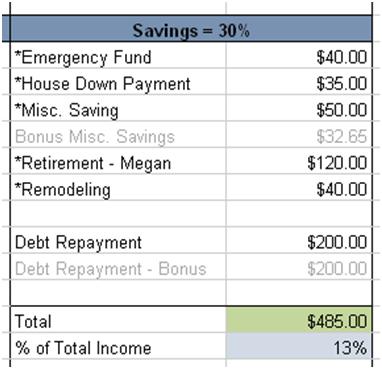

But our Savings are spread pretty thinly between our different goals, as you can see from Our January Budget:

It seems that spreading our savings efforts so thinly might not be the best strategy, so today I’m going to run through the numbers and see if a focused strategy is a better approach.

The Focused Savings Strategy

The focused savings strategy entails putting all of your money toward one savings goal at a time, usually starting with the smallest, but the timing of each goal factors in as well.

The benefit of the focused savings strategy is that the Savings add up quickly. If you have $200 to save and you put it all toward your Emergency Fund, you’ll end up with a $1,000 Beginner Emergency Fund a lot more quickly than if you only put $100 or $50 toward that emergency fund.

The downside of the focused savings strategy is that, while you’re making progress toward a single goal very quickly, you aren’t making any progress toward your other goals.

Apply the Focused Savings Strategy

Our 2012 Savings Goals – Ideal

When we sat down to talk about our finances in 2012, Ben and I first looked at what we would like to save for various things throughout the year.

This is what we came up with (priority order):

Debt Payoff: Subaru Car Loan – $730 (as of Feb 1, 2012)

Saving for School – $4,500 a year

Birthday Spending Money (first birthday is in March) – $450

Special Occasion Fund (our anniversary is in March) – $200

Travel to Michigan in May – $900

Travel to Michigan in November – $900

Christmas Spending Money – $600

Emergency Fund – $2,650

Total: $10,930 ($910 per month)

As you can see, we have quite a few things we would like to save for.

However, we only have $485 to save every month, and at the moment, most of that money is going toward paying down debt. (The amount we have to save will go up to $595 in March when we pay off the Subaru, and to $695 in June when I’m done with classes at the community college.)

So, we need some more realistic numbers.

Our 2012 Savings Goals – Realistic

Considering how much we have available to save, these are the goals we should actually be able to achieve this year (priority order):

Debt Payoff: Subaru Car Loan – $730

—–

Saving for School – $4,200

Birthday Spending Money – $250

Special Occasion Fund – $200

Travel to Michigan in May – $800

Christmas Spending Money – $600

Emergency Fund – $480

If we took the focused strategy and put the whole $485 on the first non-debt payoff goal, Saving for School, it would take us more than eight and a half months to get to our goal of $4,200. That means, for almost nine months, we wouldn’t be saving any money toward anything else, which would mean we’d have to skip our trip to Michigan in May (not really an option I’m willing to take) or pay for that trip on credit (also not an option I’m willing to take). This is why the focused strategy often starts with savings goals of smaller amounts.

So, if we started with a smaller Savings goal, like Birthday Spending Money, in one month we could save all of our birthday spending money and our special occasion spending money, and then we could move on to the next thing.

Our Focused Strategy

Organizing our Savings Goals by amount, this is how long it would take us to reach each one using the focused strategy:

| Goal Name | Starting | Goal | Time | Left Over | Paid | Date Achieved |

| Pay off Subaru* | $0 | $730 | 1.5 months | $460 | $595 | Mar 2012 |

| Birthday Spending Money | $460 | $250 | .5 months | $210 | $485 | Mar 2012 |

| Special Occasion Money | $210 | $200 | .5 months | $10 | $485 | Mar 2012 |

| Travel to Michigan in May | $10 | $800 | 1.5 months | $400 | $595 | May 2012 |

| Christmas Spending Money | $400 | $350 | .5 month | $50 | $595 | May 2012 |

| Saving for School | $50 | $4,200 | 7 months | $15 | $595 | Dec 2012 |

| Emergency Fund | $15 | $480 | 1 month | $130 | $595 | Jan 2013 |

*We pay $110 toward the Subaru each month ($10 to interest). Once the Subaru is paid off, we’ll have an extra $110 to use toward our Savings goals.

All of our goals, except the emergency fund, get funded by their deadline or by the end of December 2012, which is pretty close to exactly what we were hoping for.

It looks like the focused savings strategy is a better approach for saving quickly toward several savings goals.

Making Adjustments for Automatic Savings Plans

The only place I’ll have to do some adjusting to this strategy is that we’re currently saving a small amount every month toward long-term savings goals not listed above, like a House Down-payment and Condo Repairs (supplemental to our emergency fund). Saving for these things automatically means that money adds up overtime without any active participation on my part (other than the initial set-up). If we’re really going to devote 100% of the money we have to save toward the short-term goals listed at the start of this post, we’d have to stop saving automatically toward these goals.

I don’t like the idea of stopping our long-term savings for the short-term savings, so what I plan to do is continue saving a small amount toward each of our long-term goals ($20-$40) each month. Doing so might mean that we won’t save as much toward our bigger goals, but I’m okay with that.

What to Do with Windfalls

One of the definite upsides to using the focused savings strategy is that when we get a windfall of cash, I’ll know exactly what to do with it.

Previously, it was always a debate: do I pay off debt, or put it in savings, or what? Now, with our savings goals in a priority order, I know exactly what to do with any windfall cash, and know that putting it all toward one saving goal moves all of our goals closer to completion.

Your Two Cents

What about you? What’s your savings strategy? Do you have one? What do you do with windfall cash?