I wrote about balancing my checkbook on Tuesday, and several of you asked me for more information on how you do that, so I decided to write a blog post about it.

Older people (parents, grand parents, possibly even your older siblings) probably talk about “the importance of balancing your checkbook.” But, if you were born after 1990 (or possible 1985), you’ve probably only written a few checks in your life, and don’t even know what the fuss is about. Why use checks when we have the internet and debit cards? Right?

Whether or not you use physical checks, it’s still a good idea to keep a record of your transactions, which is what most people mean when they say “checkbook.” That’s just the form that has been used for the last several decades, so the terminology has stuck. We’ll all have to figure out new terminology that makes sense in the 21st century, but for now, ‘checkbook’ is the easiest term to use.

Why should I keep a record of my transactions?

As we’ve talked about in the Budgeting Basics Series, it’s a good idea to keep a record of your transactions so you can know how your theoretical budget is holding up against your actual spending. If you don’t keep track of your spending, you may end up with a perfectly balanced budget on paper, but be overspending your actual income and running out of cash. This has happened to me more than once.

The solution, of course, is to track your spending every month, and at the end of the month compare what you spent to your budget (what you thought you’d spend) and see how close you were. Then you tweak your budget accordingly.

That’s all well and good to say, but how do you actually do that? That’s what I’m going to show you today.

5 Steps to Balancing your Checkbook

- Step 1: Record your transactions

Step 2: Compare your transactions to your bank statement

Step 3: Balance your checkbook, i.e., compare the final total of your checkbook to your bank statement; if they match, you’re done.

Step 4: Troubleshoot – If the two totals don’t match, repeat Steps 2 and 3 to troubleshoot any discrepancies.

Step 5: Compare your checkbook spending to your budget

Step 1: Record Your Transactions

I talk about this is some detail in the Budgeting Basics Series: Just 30 Days to Understanding Your Spending Habits

What I have to tell you here isn’t much different, so I just hit the highlights of that post.

Choose your recording method:

You can choose a paper checkbook register (available at your bank for the low, low price of $0), a spreadsheet (see below to download the spreadsheet I created for this purpose), a program like YNAB (affiliate link), or a service like mint.com.

You can either record all of your transactions the moment you make them (can be slightly awkward, but is definitely the most accurate), or you can save your receipts and record your transactions at the end of the day when you get home.

After several years of forgetting to record my transactions in the moment, and being frustrated by the inaccuracy of my hand-written checkbook register, I have opted to save my receipts and enter them in the evening into my spreadsheet (and now YNAB).

If you chose the “save your receipts” option, try to remember to enter them at least once a week, if you aren’t going to do it every day. Longer than that, and you often forget what you bought at Joe’s Knick-Knack Shop and what category it should go in.

Step 2: Compare your transactions to your bank statement

Once a month, your bank sends you a bank statement, a record of your transactions for the last month. You might get a paper statement, or might be able to access your statement online, but once a month, you get one.

When you receive your statement, block off about thirty minutes to go through your checkbook and compare it to your bank statement. Go through line by line, and make sure that the bank has all of the transactions you have, and that you have all of the transactions the bank has.

My bank statement (above) shows these three transactions, two on the 4th and one on the 5th.

My transaction register shows the 7-Eleven transaction happening on the 1st, which is when I actually bought the gas. It just didn’t clear my account for three days. If I had been running closer to zero in my account, that delay could have caused some serious trouble if I was relying only on my online bank balancing to guide my spending. (See the FAQ below.)

If you find any missing transactions in your checkbook, write them in. (This is why I love spreadsheets vs. paper checkbooks… editing is so much easier.)

- FAQ: Why can’t I just rely on my bank’s records and skip this whole “recording transactions” process?

Well, you can, and it’s pretty easy to do so with the advent of online banking, but it can be dangerous. Your bank doesn’t always have the most up-to-date information about your account. Only you have that, if you keep track of your transactions every day.

That cable bill you paid $120 for on Tuesday might not clear your account until Thursday, and on Wednesday, seeing that you have $140 in your account, you go out and get dinner and drinks with your friends, spending $50. $140 – $50 = $90, which is $30 less than you need to cover your cable bill when it clears the next morning.

Bummer.

Not only is that a bummer, but it either means a bounced check, fees of up to $25, from both the bill company and the bank, or it means overdraft fees of between $25 and $36. Major bummer.

Step 3: Balance your Checkbook

Once you’ve gone through your checkbook and compared it to your bank statement, it’s important to compare the amount of money your bank thinks you have verse the amount of money that you think you have. The final page of any paper statement should have a form for balancing your checking book, like this:

Below is what it looks like filled out with this month’s numbers:

…but if your bank statements are on your computer and you don’t feel like printing it off, you can also use an online tool like this one from EducationCents.org.

Step 4: Troubleshoot

If your checkbook balance doesn’t match your statement balance, you have to go back through Steps 2 and 3 and figure out why they don’t match. Maybe you missed a transaction, maybe you got something twice.

When I balanced my checkbook on Tuesday, the first time I went through it, my statement’s balance and my bank balance weren’t the same.

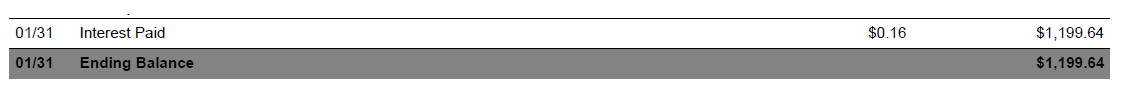

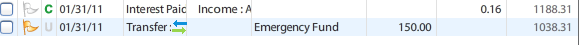

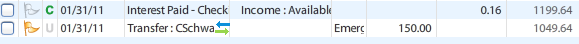

If you subtract the $150.00 that hadn’t cleared yet from my statement balance, you get $1,049.64, which means I was off by $11.33. Some people would let that ride and call it good enough, but I know from experience that if I do that, it’ll bother me. Not to mention that the one or two errors this month can compound with errors next month and in a few months I’ll be $30 or $50 off and not be able to find the exact cause.

So I went back to find the error. It turns out that I had one transaction listed twice in my account, and another one written as the wrong amount. Having fixed those errors, my final statement balance ($1,199.64 – $150 = $1,049.64) equaled my checkbook balance:

Whatever it is, you have to find it, or your checkbook won’t balance and you won’t be able to tell how accurate your budget is.

Step 5: Compare Your spending with Your Budget

This is not technically a step that is required in balancing your checkbook, but it is a really good idea.

Once you’ve gone through and made sure your records match your bank’s records, it’s a good idea to look over your spending in each of the categories you’re tracking and see how well your budgeted estimates match your actual spending.

We almost always go over on groceries. I don’t know why, because I budget more for groceries than I think we need each month, but we’re generally over by $20 or $30. I’ve been working on keeping that number down, because if I’m over in one budget category, I have to take that money from somewhere else, which I generally don’t like to do.

And that’s How to Balance Your Checkbook. If you have any questions, feel free to .

Additional Resources

- mint.com – a free, online money-management tool

- You Need a Budget.com – my favorite financial software to date, ever. (Affiliate link)

{ 3 comments… read them below or add one }

Hi,

What if the person holds your check for months, how can you keep an accurate account?

Thanks!

Hi Bev,

You just have to remember to inclue the outstanding check in your reconciliation with your bank statement at the end of each month. You might also try contacting the person and asking them to cash the check. It’s possible that they’ve misplaced it, in which case you’ll want to call your bank to void it so no unknown person can get ahold of your banking information.

Hope that helps.

Megan

That situation can be maddening, but we have to relax and deal with it. The goal is for us not to over spend. A check written is money spent, it remains recorded that way our register is going to be the most accurate record as that money is concerned. Nothing wrong with the bank balance being higher than what our register shows until long outstanding checks clear, as long we doesn’t forget that is money we can’t spend because it’s our obligation that the money be available. Now long we are legally obligated honor such checks I don’t know.

{ 6 trackbacks }