There are two ways to think about spending balance.

The first is how much you’re spending in each category of your budget (Needs, Wants, Savings) a la “The Balanced Money Formula,” introduced in the book All Your Worth (affiliate link) by Elizabeth Warren and Amelia Warren Tyagi.

The second is how much money you’re spending throughout the month and when that spending occurs. This second version is the one I’m going to be talking about today.

Spending Imbalance

I wrote the other day about controlling spending and how my husband and I have been having trouble making our money last from paycheck to paycheck.

After sitting down with Ben to discuss our finances on Saturday (we have a weekly meeting to discuss where we are financially and where we’re going next), I went through our bills and our budget and I determined something very important: Our spending is woefully out of balance.

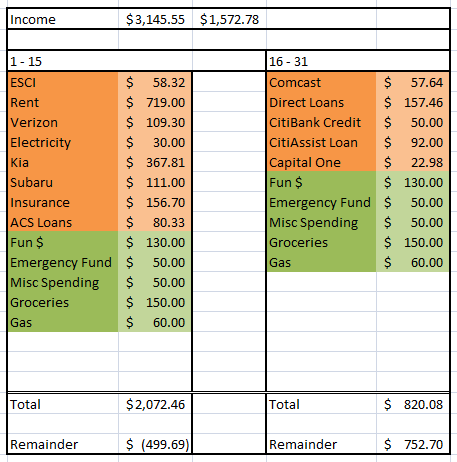

As it stands right now, more than half of our bills get paid before the fifteenth of the month, and all of the big ticket items (Rent, Car Loan, Cell Phone Bill, etc.) fall in those first fifteen days. I had been trying to spread our non-bill spending (Gas, Groceries, Fun Money) out over each paycheck we received, but the image below shows why that, in retrospect, was a very foolish idea:

As you can see, in the first half of the month, our spending was out of balance to the tune of almost $500. No wonder we were having trouble lasting from one paycheck to the next. Yikes.

Fixing the Imbalance

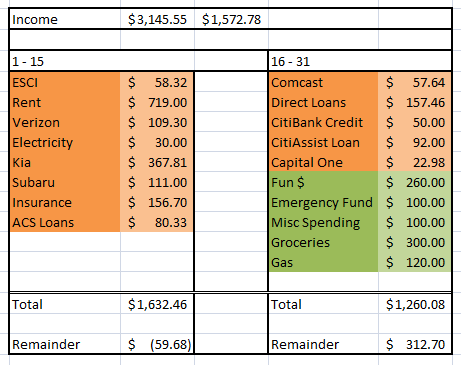

So, I decided to allocate all of our non-bill spending (Gas, Groceries, Fun Money, etc.) out of the second half of the month, where we have an extra $750 to play with. The new spending plan looks like this:

That looks much better, except that we’re still over our income by $60 in the first half of the month. The fact that all of those expenses are bills with relatively fixed due dates is a little distressing. We could pay our rent early, but that puts us over our income in the second half of the month, which is no good. What I really needed to do was move one of the $100 expenses to the second half of the month.

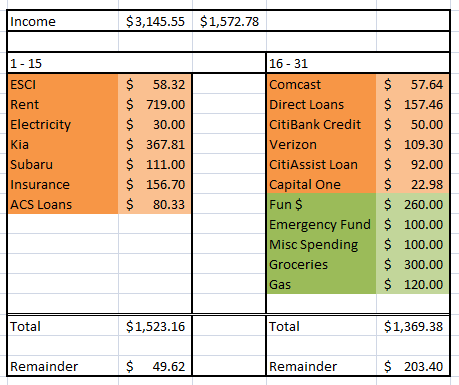

I knew that our various loans (auto and student) were going to be pretty inflexible, so I decided to see if I could change either the cell phone due date or the insurance due date. I wasn’t able to get through to the insurance company (they were having phone issues), but the cell phone company was more than willing to play.

Now, our spending plan looks like this:

$50 extra at the end of the first two weeks isn’t a lot, but it’s better than having a negative amount.

Dealing with the Logistics

My plan is to use half of the money that we budget in the second half of each month for that period (the 16th through the 30th), and save half of it for the first part of the next month when we won’t really have any extra.

So, $150 of the $300 for groceries is going to be spent at the end of this month, and $150 will be spent in the beginning of next month. And so forth.

The astute amongst you will note that there is still an extra $200 at the end of each month that is current unspoken for. I did that on purpose, because I have no idea if this new spending plan is going to work, especially right away. I decided that having a buffer of $200, at least at first, will save us from overdrafting or getting into some other sticky situation.

When I know that my calculations are correct and everything is working as it should be, then I will most likely use that money to build our Emergency Fund or pay off debt.

Try It Yourself

If you’d like to see how balanced your spending is, but don’t want to deal with making your own spreadsheet, download mine (right-click and “Save As” to download):

Spending Balance Spreadsheet (Excel 2007)

Spending Balance Spreadsheet (Excel 97-2003)

Spending Balance Spreadsheet (Open Office)

Any questions? Don’t hesitate to contact me.

{ 2 comments… read them below or add one }

Awesome post; the pictures really show what you mean by “spending out of balance”.

On two of our bills, we were given the option to choose our own due date; in both cases I selected the 18th (2 days after the 2nd payday of the month), which really helped to spread out the nasty due dates.

Yeah, being able to chose your due date is nice. Only a few of our bills give us that option, and none of them are the really big ones. But if you have the opportunity to chose due dates, it can make your life a lot easier.

{ 1 trackback }