I hate debt.

I hate having it, I hate accumulating more than I already have, and I’ve been working diligently to get rid of the debt we have.

I hate debt because it limits my freedom. I hate it because it takes up a (large) percentage of our income each month; money we would be better served saving for our future (and for emergencies)

That being said, sometimes in life you have to make tough choices.

Maxing out my credit card

My car broke down.

The headgasket blew, which on a good day is $1,900, and in my case, there were several other things wrong with the car, so it was not a good day. The something boot is cracked and leaking, the power steering pump is leaking, a few of the oil gaskets are leaking, the serpentine belts are worn, and the ingnition wires need to be replaced.

$2,220 and three days of work (on their part) and I will have my car back with a shiny new engine, one that will not require any further maintenance for 100,000 miles (which is when the timing belt will be changed). Only problem? I don’t have $2,220. Our emergency fund got used up just after we moved out here (to cover some unexpected expenses while moving) and we haven’t been able to rebuild it to more than $200.

What I do have, however, is a 0% interest credit card with a $4,000 limit and $2,500 of that limit available.

I got the 0% interest card to aid in paying off our current debt so we weren’t paying interest on the balance. My old card had an interest rate of 15%, so the decision to switch saved us a lot of money.

So, considering all of that, when I got the quote back from the repair guy, I consulted with my husband, and then told him to go ahead and do the repair.

Do I hate the idea of putting $2,220 on my credit card? Yes, yes I do.

Was it necessary? Do I need my car? Considering I just changed second jobs to one that’s half-way across town and which ends at a time when the bus doesn’t run: Yes, sadly, I do need my car.

What I’m going to do about it

In order to mitigate the fact that I hate adding to our debt, I have a plan.

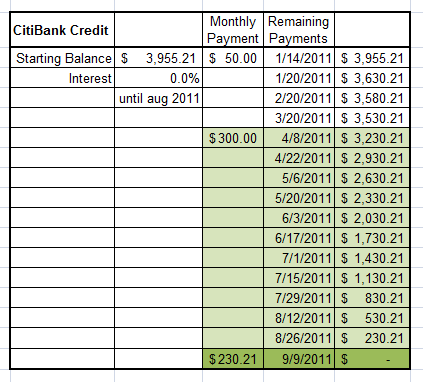

I have drawn up a detailed schedule of how we’re going to pay the credit card back down, and do so by August 2011, which is when the card’s interest rate goes up.

-

Note: If you’re going to put money on a credit card (which I do not recommend), always, always, always have a plan for paying the money back as quickly as possible. Within the same month, if that’s feasible.

And before you consider using a credit card, consider all your other options, including doing without the thing you were going to pay for with a credit card, or waiting until you have the money.

The Plan

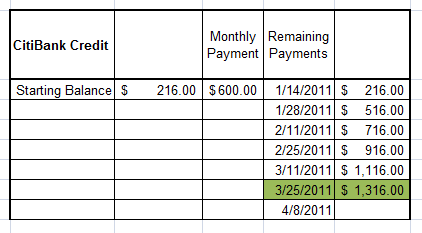

Step 1: I’m going to rebuild our emergency fund to at least $1,000. The plan is to put $600 toward our emergency fund each month, which means it should take us just under three months to get over $1,000. Ideally it would be more than that (3 to 6 months of expense, at least), but that’s enough to cover most emergencies while we pay down the rest of our debt.

Update: Apparently I fail at updating spreadsheets when I copy and paste them. This spreadsheet should read “Emergency Fund” not CitiBank Credit. Whoops.

Step 2: I’m going to put $600 a month toward our credit card debt and pay it down by August. This plan depends on my new internship extending past the 6 month mark. If it doesn’t, I have a contingency plan, although that plan might involve the monthly payments going down to $400. But we’ll cross that bridge when/if we come to it.

Step 3: When the card is paid off, I’m going to cut it up.

The Flaws in the Plan

Flaw 1: Depending on uncertain income – part 1. Putting $600 a month toward the credit card included bonus money that my husband can get every month for excelling at his job. He’s not guaranteed this money, and it may not always been the maximum amount, as it has been the last few months.

Flaw 2: Depending on uncertain income – part 2 As I mentioned, my primary job at the moment is an internship, which is only guaranteed to last five or six months, which is three or four months fewer than it will take us to pay off the credit card. If I am not kept on as a more permanent member of the staff, which is very possible, our income will be reduced enough that $600 a month would require some serious juggling and spending cutbacks. It would not be impossible, partly because I would be able to get more hours at my secondary job, which would make up some of the loss, but it would be difficult.

Flaw 3: This whole plan puts us further into debt. No matter how you slice it, we’re taking on $2,000 plus in new debt, which means limiting our financial freedom and ability to save for other goals for the duration of the time it takes us to pay down this new debt. Never mind the other debt that we have.

Going forward

Every month, near the end of the month, I’m going to update you on my progress toward paying off this new debt. This gives me accountability, and gives you a case study of a real-live debt pay off.

Stay tuned later in this week for an update of our finances where I will show the changes we made in order to pay off this new debt.

{ 1 comment… read it below or add one }

Having to put it on the card is a bummer, for sure. Of course, blowing a headgasket is really a bummer no matter what.

From a strategic point of view, though, you’ve made a good plan for handling that problem. I wrote about making plans and managing your risk (https://howtomonetize.me/risk-analysis/), and the key point is to look over your plan – as you’ve done – and identify reasons it might not work, and what you’d do about those things if they happened. So I think it’s as good a solution as can be made, considering the circumstances.

{ 2 trackbacks }